North Vancouver, B.C., March 6, 2014. Lion One Metals Limited (TSX-V: LIO) (FSE: LY1) (LOMLF: OTCQX) (ASX: LLO) (“Lion One” or the “Company”) is pleased to announce the results of the initial National Instrument (NI) 43-101 Mineral Resource Estimate (the “estimate”) for the Olary Iron Project in Braemar Iron Province, South Australia.

The technical report “Olary Iron Project Mineral Resource Estimate, South Australia” (the report”) was commissioned by the Company’s joint venture partner Yukuang Australia (WA) Resources Pty Ltd (“Yukuang”) and prepared by SRK Consulting Australasia Pty Ltd (“SRK”) in support of a listing application on the Singapore Stock Exchange. The report has been filed on the SEDAR website at www.sedar.com. Highlights of the estimate include:

Indicated mineral resources of 214 million tonnes at 26.3% iron

Inferred mineral resources of 296 million tonnes at 26.4% iron

| OLARY IRON PROJECT RESOURCE ESTIMATE SUMMARY | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| CATEGORY | TONNAGE | FE % | SIO2% | AL2O3% | LOI% | S% | P% | DTR% | DENSITY |

| Indicated | 214,000,000 | 26.3 | 40.8 | 6.9 | 3.9 | 0.029 | 0.24 | 26.4 | 3.12 |

| Inferred | 296,000,000 | 26.4 | 41.3 | 6.9 | 3.7 | 0.027 | 0.25 | 27.3 | 3.10 |

Table 1: Summary of Olary Iron Project Resource Estimate using cutoff grade of 20% Fe

| CATEGORY | CONCENTRATE TONNAGE | DTR CONCENTRATE GRADES | |||||

|---|---|---|---|---|---|---|---|

| FE % | SIO2% | AL2O3% | LOI% | S% | P% | ||

| Indicated | 57,000,000 | 69.6 | 2.9 | 0.3 | -3.1 | 0.008 | 0.01 |

| Inferred | 81,000,000 | 69.8 | 2.6 | 0.2 | -3.1 | 0.009 | 0.008 |

Table 2: Davis Tube Recovery (DTR) test results and Fe content for the magnetic concentrate for composite RC and Diamond drillhole samples at grind size of 38 microns and 10% DTR cut-off grade

Olary Iron Joint Venture

Lion One holds a 47% interest in the Project, comprising a 22% optional contributing interest and a 25% interest free carried to the completion of a bankable feasibility study and decision to mine. Lion One’s 25% free carried interest is convertible on a decision to mine to a 2% FOB royalty, or a 1% FOB royalty with a $.50 per tonne production royalty.

Yukuang is an affiliated enterprise of the Henan Provincial Bureau of Geo-exploration and Mineral Development, a state-owned mining and mineral exploration company with corporate headquarters in Zhengzhou, Peoples’ Republic of China. Yukuang has earned a 53% interest in the Project’s iron rights through a farm-in agreement with Lion One Australia Pty Ltd. Total joint venture expenditures to date exceed AUD$7 million.

Olary Resource Estimate

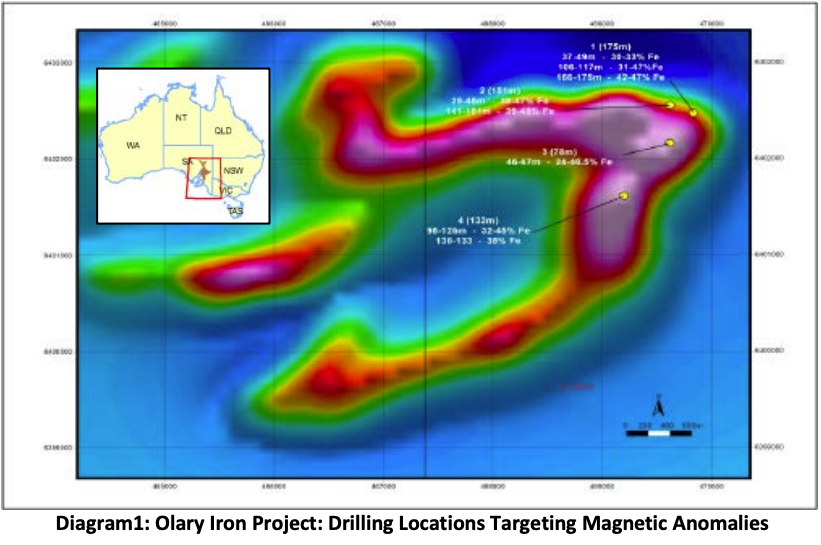

The estimate is based on assay results from 55 diamond and reverse circulation drill holes totalling 16,281 meters drilled on the northern end of the target zone on the Olary Property. Iron mineralization on the Olary Creek Property is related to ironstones of the Braemar Iron Formation, a regional magnetite belt extending approximately 180 km through eastern South Australia. To-date only one-third of the 7km strike length of the Olary iron target zone has been drilled and the deposit remains open for expansion.

Diagram 1: Olary Iron Project: Drilling Locations Targeting Magnetic Anomalies

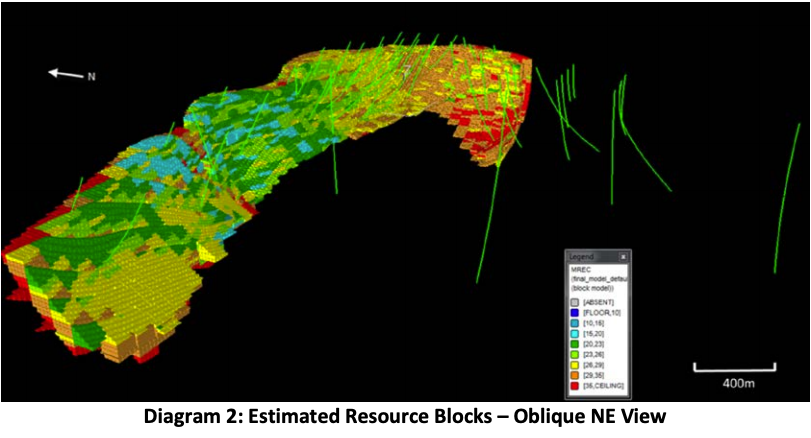

Diagram 2: Estimated Resource Blocks — Oblique NE View

Sample Preparation

Sample preparation was undertaken by ALS in Adelaide and assay analyses were undertaken by ALS in Perth. Drillhole logs were generated for lithology, structure and geotechnical information. The median core and RC sample interval was 3.0 m, representing 41% and 71% of samples respectively. Samples were assayed for total analysis and by DTR using XRF and were assayed for 25 elements and compounds. A total of 266 samples were laboratory measured for bulk density from 4 drillholes. 75% of drillholes were downhole surveyed for bulk density and a regression was determined by comparing with the laboratory bulk densities. SRK maintained regular contact with ALS and reviewed their sample preparation and analytical procedures for total concentration, DTR and bulk density tests.

Qualified Persons

Mr. Paul Francis Hunter, MSc, MAusIMM(CP), Principal Consultant, SRK Australasia, and Mr. Daniel Jasper Kentwell, MSc, FAusIMM, Principal Consultant, of SRK Australasia are Qualified Persons as defined by NI 43-101 and are responsible for the estimate. They have reviewed, verified, and approved the technical information in this news release, and the underlying sample, analytical, and test data. The estimate is classified as an indicated or inferred mineral resource according to CIM Definitions under NI 43-101. Mineral resources are not mineral reserves and have no demonstrated economic viability. The Company is not aware of any environmental, permitting, legal, title, taxation, socio-political, or other issues that may materially affect its estimate of mineral resources. There has been no additional exploration activity that is material to the estimate since the completion date of the SRK estimate.

The information contained in this release has been reviewed and approved by Rob McLeod, P.Geo, a consultant to the Company and a Qualified Person as defined by NI 43-101.

Competent Person Statement

The information in this report that relates to Exploration Results and Mineral Resources is based on information compiled by Mr. Stephen Mann, who is a Member of the Australian Institute of Mining and Metallurgy (AUSIMM). Mr. Mann has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which the Company is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves” (JORC Code). Mr. Mann is a director of Lion One Metals Limited and consents to the inclusion of the information in this announcement in the form and context in which it appears.

Additional information including tables, cross-sections, and plan maps will be available shortly on the Company website at www.liononemetals.com.

About Lion One Metals Limited

Lion One Metals Limited is a Canadian resource company focused on the acquisition, exploration and development of mineral projects worldwide. The Company is focused on advancing the Tuvatu Gold Project in Fiji, the Olary Creek Iron Ore Project in South Australia, and additional exploration-stage projects in Fiji, Australia, and Argentina.

On Behalf of the Board of Directors

“Walter H. Berukoff”

Chairman of the Board

Lion One Metals Limited

www.liononemetals.com

For further information contact:

Investor Relations

Tel: 604-998-1250

Fax: 604-998-1253

info@liononemetals.com

Neither the TSX Venture Exchange nor its Regulation Service Provider accepts responsibility for the adequacy or accuracy of this release.

This press release may contain “forward-looking information” within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward looking information. Generally, forward-looking information may be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “proposed”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases, or by the use of words or phrases which state that certain actions, events or results may, could, would, or might occur or be achieved. This forward-looking information reflects Lion One Metals Limited’s current beliefs and is based on information currently available to Lion One Metals Limited and on assumptions Lion One Metals Limited believes are reasonable. These assumptions include, but are not limited to, the actual results of exploration projects being equivalent to or better than estimated results in technical reports, assessment reports, and other geological reports or prior exploration results. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Lion One Metals Limited or its subsidiaries to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: the early stage development of Lion One Metals Limited, general business, economic, competitive, political and social uncertainties; the actual results of current research and development or operational activities; competition; uncertainty as to patent applications and intellectual property rights; product liability and lack of insurance; delay or failure to receive board or regulatory approvals; changes in legislation, including environmental legislation, affecting mining, timing and availability of external financing on acceptable terms; not realizing on the potential benefits of technology; conclusions of economic evaluations; and lack of qualified, skilled labor or loss of key individuals. Although Lion One Metals Limited has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. Lion One Metals Limited does not undertake to update any forward-looking information, except in accordance with applicable securities laws.