North Vancouver, B.C., January 25, 2023 - Lion One Metals Limited (TSX-V: LIO) (OTCQX: LOMLF) (ASX: LLO) (“Lion One” or the “Company”) announces further high-grade assay results ongoing Zone 500 drilling at the Company’s 100%-owned Tuvatu Alkaline Gold Project in Fiji.

Underground drill holes TUG-147 and TUG-150 were drilled to further test the high-grade zone originally defined by drill holes TUG-141, TUDDH-601 and TUDDH-608, previously reported on June 6, 2022, August 15, 2022, and November 7, 2022, respectively. Highlights include:

| Hole ID | From (m) | To (m) | Interval (m) | Au g/t | Lode |

| TUG 147 | 263.1 | 274.2 | 11.1 | 10.67 | UR2 |

| including | 263.1 | 268.8 | 5.7 | 13.45 | UR2 |

| which includes | 265.5 | 266.7 | 1.2 | 51.18 | UR2 |

| which includes | 265.5 | 265.8 | 0.3 | 144.31 | UR2 |

| and includes | 268.2 | 268.5 | 0.3 | 16.02 | UR2 |

| and including | 270.0 | 274.2 | 4.2 | 9.86 | UR2 |

| which includes | 272.1 | 272.7 | 0.6 | 45.82 | UR2 |

| and | 273.6 | 273.9 | 0.3 | 11.95 | UR2 |

| 311.1 | 313.8 | 2.7 | 4.18 | UR1 | |

| including | 311.4 | 311.7 | 0.3 | 15.81 | UR1 |

| TUG-150 | 225.6 | 227.1 | 1.5 | 17.02 | UR3 |

| including | 226.5 | 227.1 | 0.6 | 39.20 | UR3 |

| 270.9 | 273.0 | 2.1 | 3.6 | UR3 | |

| including | 272.4 | 272.7 | 0.3 | 11.93 | UR3 |

| 315.3 | 323.7 | 8.4 | 8.84 | UR2 | |

| including | 315.6 | 315.9 | 0.3 | 108.57 | UR2 |

| including | 318.6 | 319.8 | 1.2 | 14.71 | UR2 |

| which includes | 318.6 | 318.9 | 0.3 | 28.51 | UR2 |

| 327.6 | 327.9 | 0.3 | 59.85 | UR2 | |

| 329.7 | 330.3 | 0.6 | 11.49 | UR2 | |

| including | 330.0 | 330.3 | 0.3 | 18.24 | UR2 |

| 350.1 | 351.9 | 1.8 | 4.26 | UR2 | |

| including | 351.3 | 351.6 | 0.3 | 12.85 | UR2 |

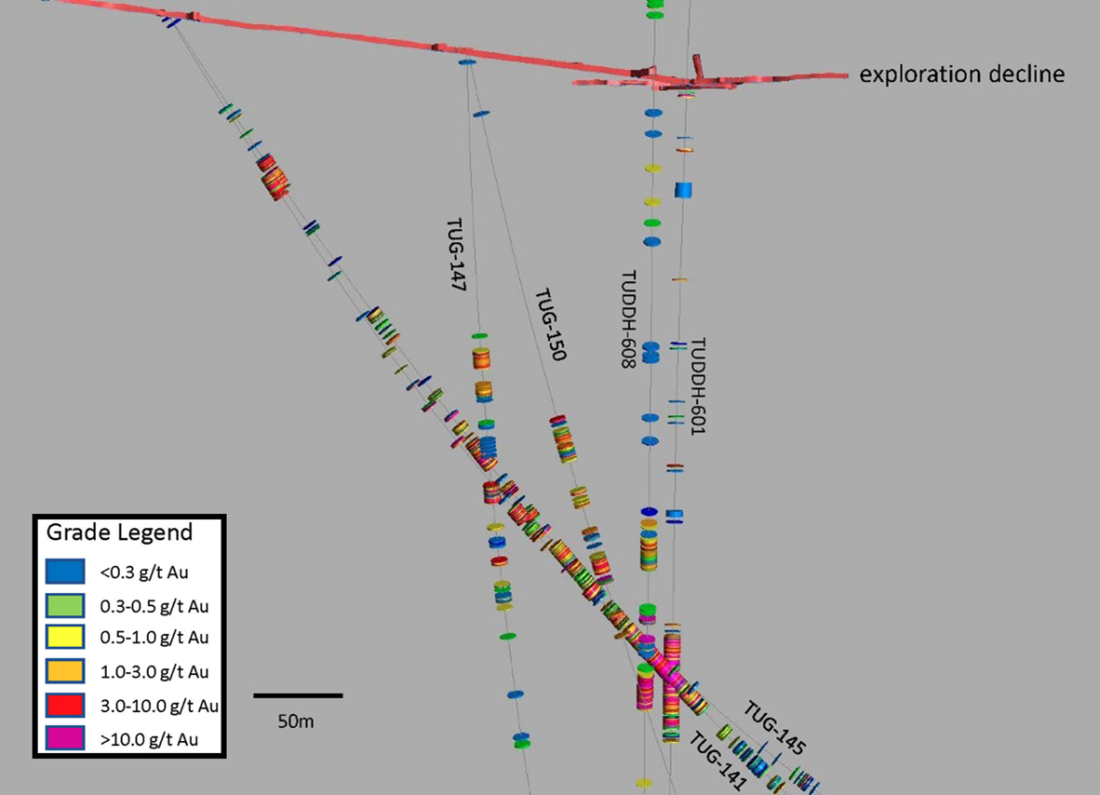

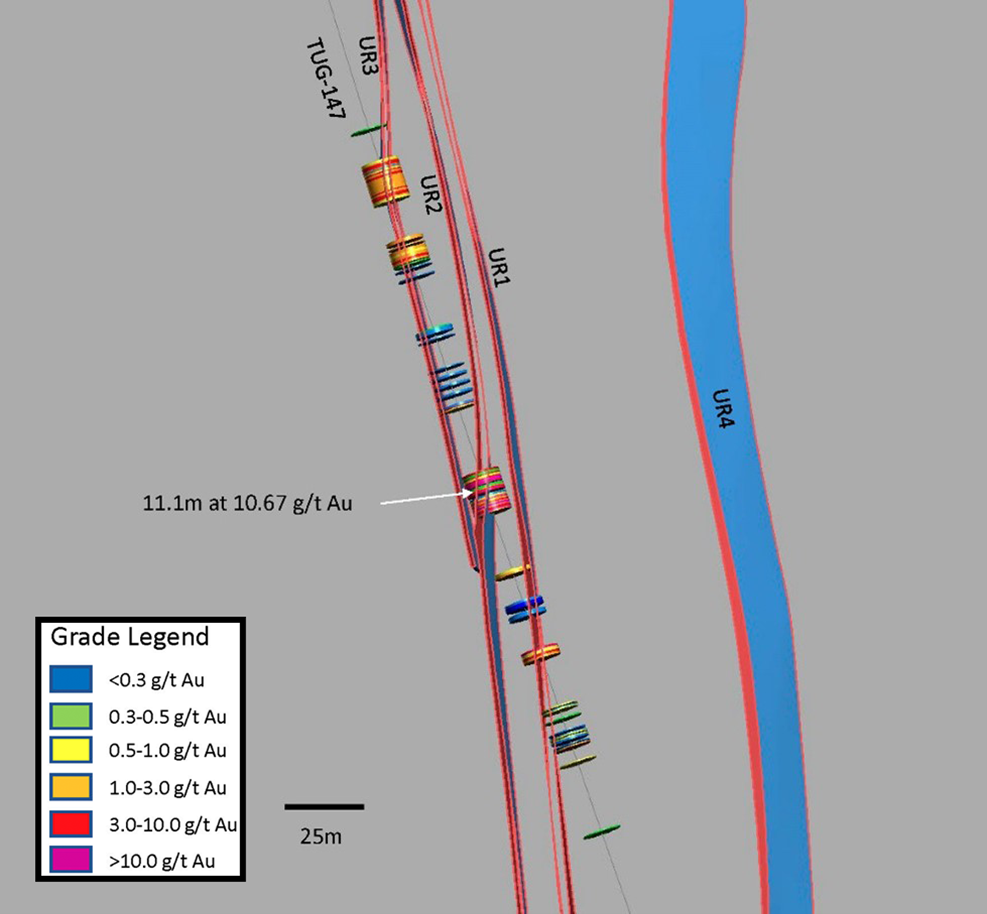

TUG-147 was drilled to cross the northern extension of the UR2-UR1 NS lodes that appear to define a wedge-shaped high-grade zone bounded by the UR2 and UR4 lodes, to thus test the mineralization associated with UR lodes, and to provide structural information on the orientations of mineralized veins and lode arrays. The drillhole lifted more than expected and crossed the zone at a somewhat lower elevation (shallower) than intended (Figure 1). Nevertheless, TUG-147 drilling across the UR2 structure, intersected 11.1m at 10.67 g/t Au from 263.1 to 274.4m, which includes 5.7m at 13.45 g/t Au, including 1.2m at 51.18 g/t Au, and 4.2m at 9.86 g/t Au corresponding to the intersection of the main NS-trending UR2 lode and NE-trending mineralized veining (Figure 2, Table 1). The calculated true horizontal width of this intersection is 3.5m.

Figure 1. Vertical section looking east showing the positions of TUG-147 and TUG-150 relative to the drill holes that defined high-grade mineralization TUG-141, TUDDH-601 and TUDDH-608.

Figure 2. Vertical section looking north showing the mineralized interval in TUG-147 of 11.1m at 10.67 g/t Au corresponding to the UR2 lode.

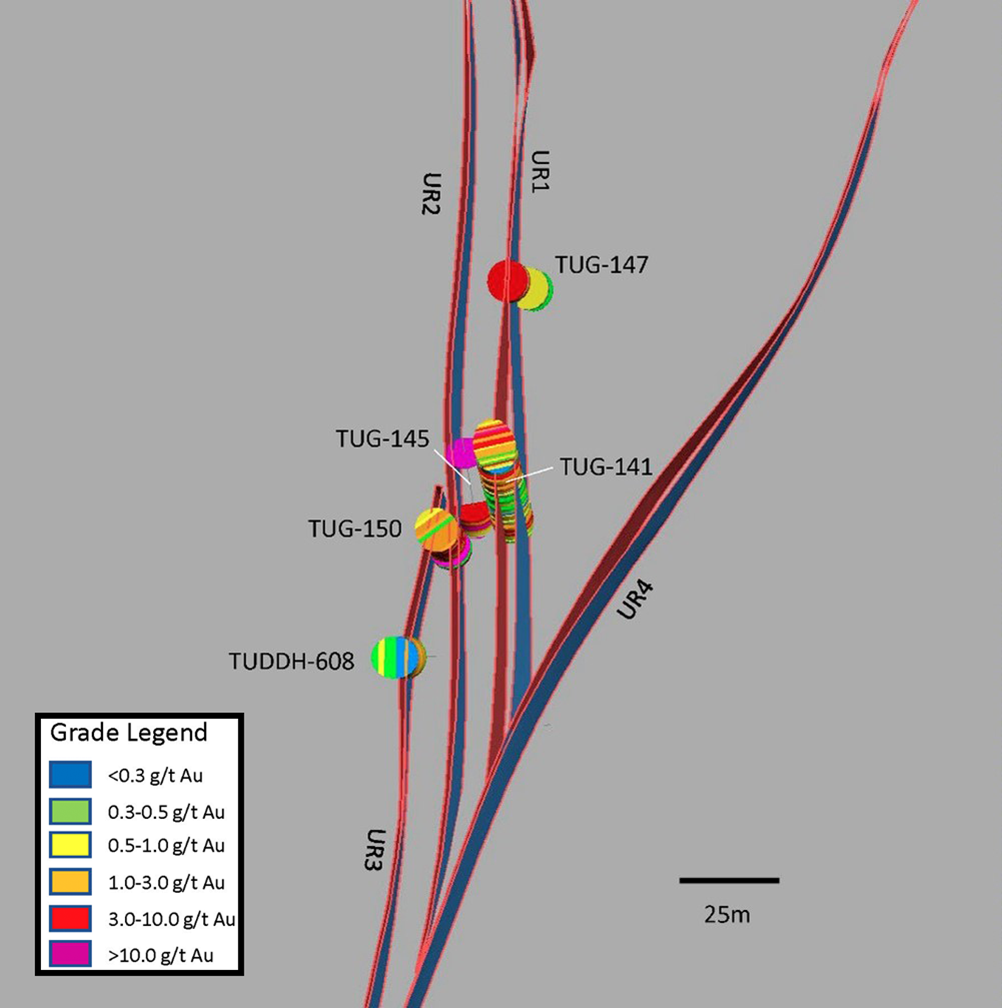

TUG-150 was targetted to cross the high-grade zone below TUG-141 and north of TUDDH-608. The hole drifted to the right (south) more than expected and only skimmed along the UR2 lode at a low angle, without crossing the high-grade zone at the targetted location (Figures 1 & 3). Nevertheless, very high-grade mineralization was intersected over a significant downhole length of 8.4m at 8.84 g/t Au, including 0.3m at 108.57 g/t Au, and 1.2m at 14.71 g/t Au which includes 0.3m at 28.51 g/t Au along the UR2 lode, further confirming the bonanza grade nature of the UR2 lode at this location (Figure 4, Table 1). A follow-up drill hole (TUG-152) still currently drilling, was collared from the same setup but with modified azimuth and dip, and represents an additional attempt to drill across the UR2 structure near this location, and to test the possible NE down-plunge extent to the mineralization recorded by TUDDH-608 see Nov. 7, 2022 news release. The results of TUG-152 will be reported pending completion.

The structural information gained from the oriented core measurements collected from holes TUG-147 & TUG-150 are presented and discussed in the AME Roundup slide deck located on the website at this location https://liononemetals.com/investors/presentations/

Figure 3. Horizontal plan looking straight down showing the location of TUG-147 and TUG-150 drill hole traces relative to the high-grade mineralization defined by TUG-141. The TUG-150 hole did not cross the UR2-UR1 mineralized corridor, remaining along the UR2 structure.

Figure 4. Photos of mineralization from TUG-150: A, B) 315.9m, 0.3m at 108.57 g/t Au, red circle indicates coarse VG; C) 318.9m, 0.3m at 28.51 g/t Au; D) 327.9m, 0.3m at 59.85 g/t Au. Red circle on the right indicates VG observed.

Table 1. Composited results from TUG-147 and TUG-150 drilling. The interpreted lode for each composited intercept is indicated.

| Hole ID | From (m) | To (m) | Interval (m) | Au g/t | Lode |

| TUG-147 | 179.1 | 189.9 | 10.8 | 2.26 | UR3 |

| 200.1 | 206.4 | 6.3 | 1.21 | UR3 | |

| 245.4 | 246.0 | 0.6 | 2.51 | ||

| 263.1 | 274.2 | 11.1 | 10.67 | UR2 | |

| including | 263.1 | 268.8 | 5.7 | 13.45 | UR2 |

| which includes | 265.5 | 266.7 | 1.2 | 51.18 | UR2 |

| which includes | 265.5 | 265.8 | 0.3 | 144.31 | UR2 |

| and includes | 268.2 | 268.5 | 0.3 | 16.02 | UR2 |

| and including | 270.0 | 274.2 | 4.2 | 9.86 | UR2 |

| which includes | 272.1 | 272.7 | 0.6 | 45.82 | UR2 |

| and | 273.6 | 273.9 | 0.3 | 11.95 | UR2 |

| 273.9 | 274.2 | 0.3 | 1.92 | UR2 | |

| 289.8 | 291.0 | 1.2 | 0.97 | ||

| 311.1 | 313.8 | 2.7 | 4.18 | UR1 | |

| including | 311.4 | 311.7 | 0.3 | 15.81 | UR1 |

| 326.7 | 327.0 | 0.3 | 0.69 | ||

| 327.6 | 327.9 | 0.3 | 0.58 | ||

| 334.5 | 334.8 | 0.3 | 0.54 | ||

| 335.1 | 335.4 | 0.3 | 0.53 | ||

| 337.5 | 337.8 | 0.3 | 1.72 | ||

| 341.7 | 342.0 | 0.3 | 0.8 | ||

| 537.0 | 539.1 | 2.1 | 1.84 | ||

| 540.9 | 543.9 | 3.0 | 0.79 | ||

| 555.6 | 556.2 | 0.6 | 0.73 | ||

| TUG-150 | 225.6 | 227.1 | 1.5 | 17.02 | UR3 |

| including | 226.5 | 227.1 | 0.6 | 39.2 | UR3 |

| 232.8 | 233.4 | 0.6 | 0.95 | UR3 | |

| 234.6 | 240.0 | 5.4 | 2.25 | UR3 | |

| 242.1 | 245.7 | 3.6 | 2.32 | UR3 | |

| 248.4 | 249.6 | 1.2 | 2.59 | UR3 | |

| 251.1 | 252.0 | 0.9 | 0.94 | UR3 | |

| 270.9 | 273.0 | 2.1 | 3.6 | UR3 | |

| including | 272.4 | 272.7 | 0.3 | 11.93 | UR3 |

| 276.0 | 276.6 | 0.6 | 0.66 | UR3 | |

| 278.4 | 279.0 | 0.6 | 0.69 | UR3 | |

| 280.2 | 281.1 | 0.9 | 1.91 | UR3 | |

| 296.4 | 297.9 | 1.5 | 2.01 | UR3 | |

| 300.6 | 300.9 | 0.3 | 4.7 | UR3 | |

| 312.3 | 313.5 | 1.2 | 0.62 | UR3 | |

| 315.3 | 323.7 | 8.4 | 8.84 | UR2 | |

| including | 315.6 | 315.9 | 0.3 | 108.57 | UR2 |

| including | 318.6 | 319.8 | 1.2 | 14.71 | UR2 |

| which includes | 318.6 | 318.9 | 0.3 | 28.51 | UR2 |

| 327.6 | 327.9 | 0.3 | 59.85 | UR2 | |

| 329.7 | 330.3 | 0.6 | 11.49 | UR2 | |

| including | 330.0 | 330.3 | 0.3 | 18.24 | UR2 |

| 350.1 | 351.9 | 1.8 | 4.26 | UR2 | |

| including | 351.3 | 351.6 | 0.3 | 12.85 | UR2 |

| 363.6 | 364.8 | 1.2 | 2.44 | UR2 |

Table 2. Survey details of diamond drill holes referenced in this release.

| Hole No | Coordinates (Fiji map grid) | RL | final depth | dip | azimuth | |

| N | E | m | m | Deg. | (TN) | |

| TUG-147 | 3920584.2 | 1876438.2 | 115.1 | 582.0 | -75 | 095 |

| TUG-150 | 3920584.8 | 1876436.5 | 115.9 | 467.3 | -71 | 130 |

| TUG-152 | 3920584 | 1876436 | 115 | in progress | -72 | 123 |

About Tuvatu

The Tuvatu Alkaline Gold Project is located on the island of Viti Levu in Fiji. The January 2018 mineral resource for Tuvatu as disclosed in the technical report “Technical Report and Preliminary Economic Assessment for the Tuvatu Gold Project, Republic of Fiji”, dated September 25, 2020, and prepared by Mining Associates Pty Ltd of Brisbane Qld, comprises 1,007,000 tonnes indicated at 8.50 g/t Au (274,600 oz. Au) and 1,325,000 tonnes inferred at 9.0 g/t Au (384,000 oz. Au) at a cut-off grade of 3.0 g/t Au. The technical report is available on the Lion One website at www.liononemetals.com and on the SEDAR website at www.sedar.com.

Qualified Person

In accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43- 101”), Sergio Cattalani, P.Geo, Senior Vice President Exploration, is the Qualified Person for the Company and has reviewed and is responsible for the technical and scientific content of this news release.

QAQC Procedures

Lion One adheres to rigorous QAQC procedures above and beyond basic regulatory guidelines in conducting its sampling, drilling, testing, and analyses. The Company utilizes its own fleet of diamond drill rigs, using PQ, HQ and NQ sized drill core rods. Drill core is logged and split by Lion One personnel on site. Samples are delivered to and analyzed at the Company’s geochemical and metallurgical laboratory in Fiji. Duplicates of all samples with grades above 0.5 g/t Au are both re-assayed at Lion One’s lab and delivered to ALS Global Laboratories in

Australia (ALS) for check assay determinations. All samples for all high-grade intercepts are sent to ALS for check assays. All samples are pulverized to 80% passing through 75 microns. Gold analysis is carried out using fire assay with an AA finish. Samples that have returned grades greater than 10.00 g/t Au are then re-analyzed by gravimetric method. For samples that return greater than 0.50 g/t Au, repeat fire assay runs are carried out and repeated until a result is obtained that is within 10% of the original fire assay run. Lion One’s laboratory can also assay for a range of 71 other elements through Inductively Coupled Plasma Optical Emission Spectrometry (ICP-OES), but currently focuses on a suite of 9 important pathfinder elements. All duplicate anomalous samples are sent to ALS labs in Townsville QLD and are analyzed by the same methods (Au-AA26, and Au-GRA22 where applicable). ALS also analyses 33 pathfinder elements by HF-HNO3-HClO4 acid digestion, HCl leach and ICP-AES (method ME-ICP61).

About Lion One Metals Limited

Lion One’s flagship asset is 100% owned, fully permitted high grade Tuvatu Alkaline Gold Project, located on the island of Viti Levu in Fiji. Lion One envisions a low-cost high-grade underground gold mining operation at Tuvatu coupled with exciting exploration upside inside its tenements covering the entire Navilawa Caldera, an underexplored yet highly prospective 7km diameter alkaline gold system. Lion One’s CEO Walter Berukoff leads an experienced team of explorers and mine builders and has owned or operated over 20 mines in 7 countries. As the founder and former CEO of Miramar Mines, Northern Orion, and La Mancha Resources, Walter is credited with building over $3 billion of value for shareholders.

On behalf of the Board of Directors of Lion One Metals Limited

“Walter Berukoff”, Chairman and CEO

Contact Investor Relations

Toll Free (North America) Tel: 1-855-805-1250

Email: info@liononemetals.com

Website: www.liononemetals.com

Neither the TSX Venture Exchange nor its Regulation Service Provider accepts responsibility for the adequacy or accuracy of this release

This press release may contain statements that may be deemed to be "forward-looking statements" within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward-looking information. Generally, forward-looking information may be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "proposed", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases, or by the use of words or phrases which state that certain actions, events or results may, could, would, or might occur or be achieved. This forward-looking information reflects Lion One Metals Limited’s current beliefs and is based on information currently available to Lion One Metals Limited and on assumptions Lion One Metals Limited believes are reasonable. These assumptions include, but are not limited to, the actual results of exploration projects being equivalent to or better than estimated results in technical reports, assessment reports, and other geological reports or prior exploration results. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Lion One Metals Limited or its subsidiaries to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: the stage development of Lion One Metals Limited, general business, economic, competitive, political and social uncertainties; the actual results of current research and development or operational activities; competition; uncertainty as to patent applications and intellectual property rights; product liability and lack of insurance; delay or failure to receive board or regulatory approvals; changes in legislation, including environmental legislation, affecting mining, timing and availability of external financing on acceptable terms; not realizing on the potential benefits of technology; conclusions of economic evaluations; and lack of qualified, skilled labour or loss of key individuals. Although Lion One Metals Limited has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. Lion One Metals Limited does not undertake to update any forward-looking information, except in accordance with applicable securities laws.