North Vancouver, B.C., August 15, 2022 – Lion One Metals Limited (TSX-V: LIO) (OTCQX: LOMLF) (ASX: LLO) (“Lion One” or the “Company”) is pleased to announce results from ongoing follow-up drilling to the previously reported high-grade intercept of 75.90m of 20.86 g/t Au in TUG-141 (June 6, 2022 NR), at its Tuvatu Alkaline Gold Project in Fiji.

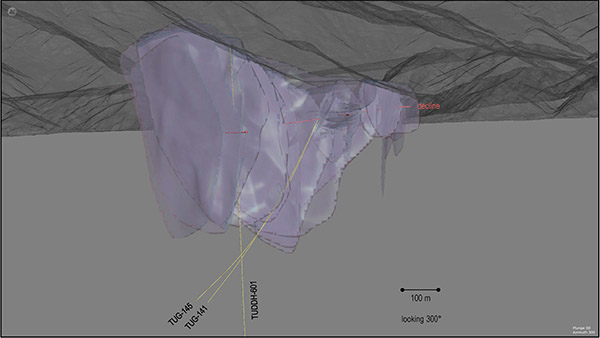

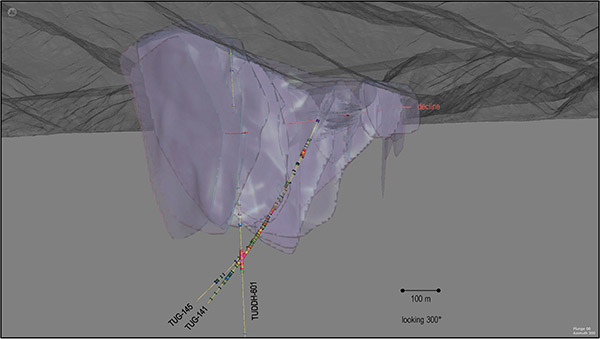

Results for the first two diamond drill holes carried out as follow-up drilling from the significant new feeder zone mineralization in TUG-141 and reported on June 6, 2022 have been received and compiled. TUDDH-601 was drilled from surface at -85° and was designed to further test the high-grade zone encountered in TUG-141, and TUG-145 was drilled from the same underground collar location as TUG-141, collared at 3° steeper, and designed to test directly below the TUG-141 drill trace (Figure 1). TUG-145 drifted to the west and lifted more than expected.

Highlight intercepts from holes TUDDH-601 and TUG-145 include:

TUDDH-601

- 26.20 g/t Au over 1.20m from 165.7-166.9m;

- 115.42 g/t Au over 1.80m from 252.4-254.2m;

- 12.22 g/t Au over 54.90m from 576.1-631.0m, including

- 23.02 g/t Au over 20.10m from 576.1-596.2m, which includes 29.24 g/t Au over 15.6m;

- 8.09 g/t Au over 20.70m from 602.5-623.2m, which includes 9.25 g/t Au over 7.80m and 15.03 g/t Au over 5.40m

TUG-145

- 6.72 g/t Au over 15.30m from 110.4-125.7m, including

- 41.16 g/t Au over 1.20m from 117.3-118.5m;

- 20.38 g/t Au over 0.90m from 278.7-279.6m;

- 28.68 g/t Au over 1.80m from 305.4-307.2m;

- 4.69 g/t Au over 10.20m from 357.9-368.1m, including

- 9.58 g/t Au over 1.20m from 358.8-360.0m,

- 6.99 g/t Au over 1.20m 362.1-363.3m, and

- 8.41 g/t Au over 1.50m from 363.9-365.4m

- 17.80 g/t Au over 0.30m from 405.9-406.2m;

- 8.73 g/t Au over 6.00m from 424.2-430.2, including

- 31.94 g/t Au over 1.20m from 426.3-427.5m

- 18.15 g/t Au over 0.60m from 598.5-599.1m

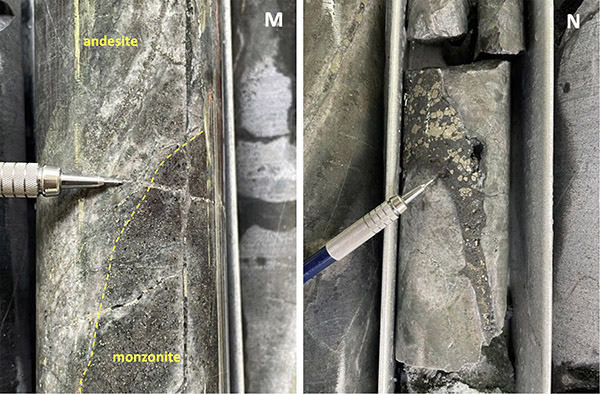

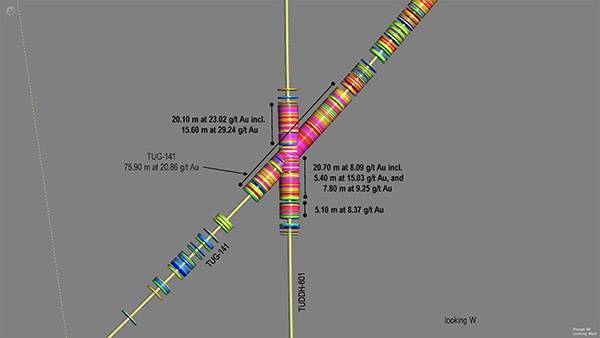

TUDDH-601 drilled from surface, was a near-vertical drill test of the high-grade gold zone encountered by TUG-141. TUDDH-601 is estimated to have drilled to within <2m of TUG-141. This test indicates that high-grade mineralization corresponding to that in TUG-141 is indeed hosted primarily by altered andesite rather than adjacent monzonite. High-grade mineralization, 54.9m of 12.22 g/t Au, was first intersected at a downhole depth of 576.1m continuing virtually uninterrupted to a downhole depth of 631.0m (Figure 2). Only one low-grade interval, hosted by monzonite and measuring 6.3m long was intersected. Above this low-grade interval, 23.02 g/t Au over 20.1m was encountered including 29.24 g/t Au over 15.60m, and below, 8.09 g/t Au over 20.7m, including 15.03 g/t Au over 5.40m and 9.25 g/t Au over 7.80m, respectively (Figure 3).

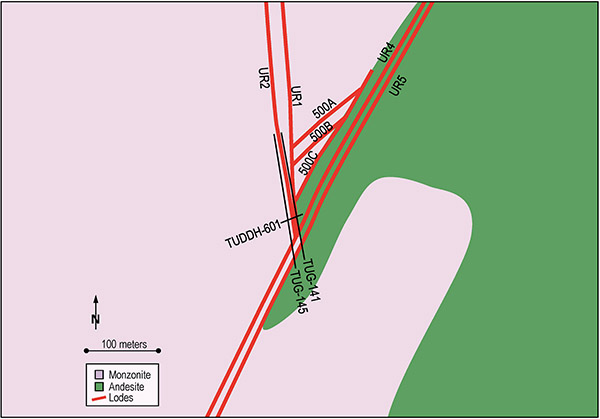

TUG-145 represented an inclined hole 3° steeper than TUG-141, drilled from the same underground collar location (Table 2 below). The hole drifted west and lifted such that the effective distance between TUG-141 and TUG-145 was approximately 21m at the 600m depth mark, with TUG-145 west of TUG-141. While TUG-141 drilled out of the less favourable monzonite and into the favourable andesite at approximately 390m depth, TUG-145 remained in monzonite until a depth of approximately 600m, indicating a southward shift of this lithological contact at this location, as illustrated schematically in Figure 4. It is thought that the monzonite to andesite contact recorded by TUG-141, is shifted south along a N-S structure, likely UR1, and that the high-grade continuous mineralization recorded by TUG-141 is largely focussed on the andesite side (east side) of this contact. Therefore, Lion One believes that the lithological contact between monzonite and andesite forms a primary control on high-grade mineralization at this location, and that the projection of this contact to depth as well as along strike, represents a first-order target for further follow-up drilling.

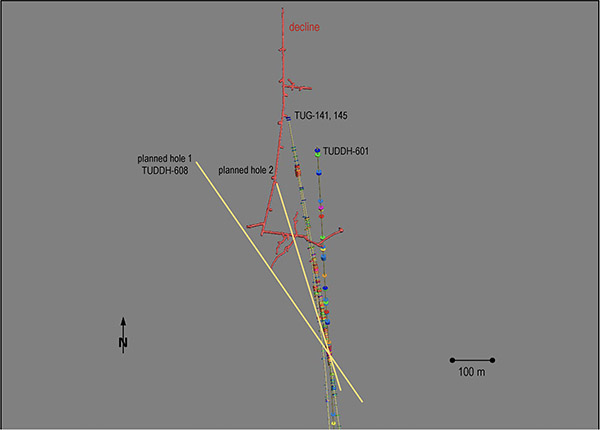

The next two planned follow up holes to TUG-141 are shown on Figure 5 below. One hole from surface, already underway as TUDDH-608, was collared at a planned azimuth of N089° and dip of -65°, targeting the high-grade intercept in TUG-141, and a second hole will collar from underground, approximately 180m further south along the decline from the TUG-141 and 145 collars, and target the same high-grade intercept at a planned azimuth of N139° and dip of -66°. The combination of these two holes should provide good information on the potential width and possible down plunge extent of the TUG-141/TUDDH-601 high-grade zone, which should allow for a realistic estimate of the volume, and hence contained Au ounces, in this zone.

Lion One technical advisor Quinton Hennigh stated, “As we drill more, the geologic setting of this important feeder zone is coming into clarity. It occurs at a major structural intersection where the north-south-trending UR1 & 2 lodes meet the northeast-trending UR4 & 5 lodes. Importantly, high-grade mineralization appears to be focussed within andesite host rocks just outboard from the contact with less favourable monzonite. With this understanding, we believe that further high-grade can be pursued along this contact at depth. The team is currently lining up more holes to test this extension.”

Lion One CEO Walter Berukoff further stated, “The spectacular discovery previously announced as the result of drilling hole TUG-141 has been confirmed by follow-up drilling in hole TUDDH-601. The positive confirmation of the longest high-grade intercept yet recorded at Tuvatu gives us further confidence that we are just now beginning to unlock the true potential of the 500 Zone high-grade feeder. The persistent success of our systematic drilling programs at Tuvatu underscores the significance of Tuvatu as a potentially multi-million ounce, world-class high-grade Au deposit.”

Figure 1. Image from Leapfrog software showing the modeled lodes representing the Tuvatu resource in semi-transparent gray with the traces of drill holes TUG-141, TUG-145 drilled from the same location along the exploration decline, and TUDDH-601 drilled at a dip of -85° from surface. Lower image overlays the mineralized intervals as colored discs that reflect grade (see Figure 3 caption for grade scale).

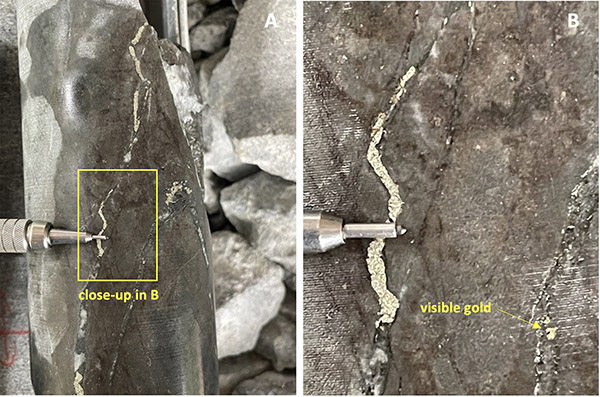

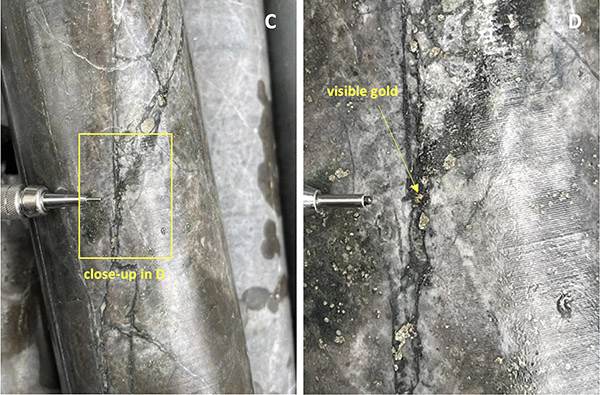

Figure 2. A) TUDDH-601 at 579.7m showing pervasively altered andesite grading 142.33 g/t Au; B) close-up of photo A; C) TUDDH-601 at 580.0m grading 108.99 g/t Au; D) close-up of photo C.

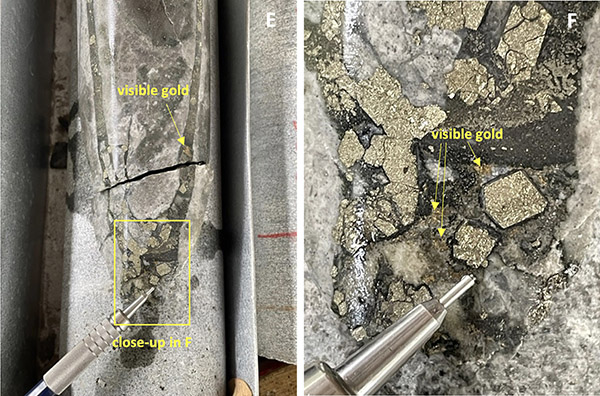

Figure 2 contd. E) TUDDH-601 at 580.2m qtz-py hydrothermal bx vein grading 140.99 g/t Au; F) close-up of photo A; G) TUDDH-601 at 583.5m showing hydrofractured qtz-py vein grading 4.73 g/t Au; H) TUDDH-601 at 593.9m showing coarse visible gold in qtz-py veining grading 230.37 g/t Au.

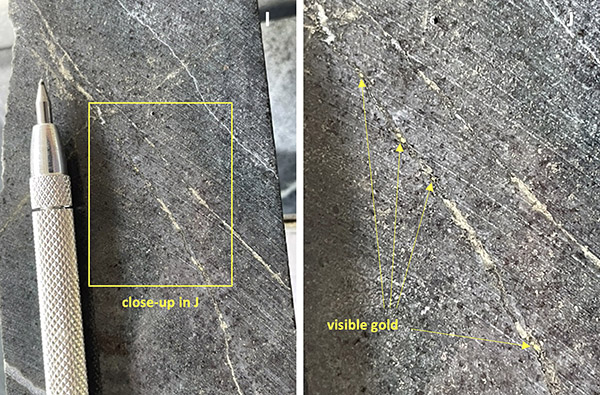

Figure 2 contd. I) TUDDH-601 at 592.2m showing very fine py-VG veins in pervasively altered andesite grading 33.77 g/t Au; J) close-up of photo I; K) TUDDH-601 at 609.0m qtz-py-roscoelite vein grading 10.49 g/t Au; L) TUDDH-601 at 610.8m qtz-py vein grading 20.31 g/t Au.

Figure 2 contd. M) TUDDH-601 monzonite-andesite contact at 617.0m grading 5.48 g/t Au; N) TUDDH-601 at 617.8m qtz-py vein in bleached andesite grading 11.67 g/t Au; O) TUDDH-601 at 621.5m qtz-py vein in bleached andesite grading 2.54 g/t Au; P) TUDDH-601 at 628.3m qtz-py vein in sercitized andesite grading 20.14 g/t Au.

Figure 3. Vertical section looking West of the mineralized intervals in TUG-141 and TUDDH-601 that were drilled in essentially the same plane. Grades in ppm Au shown as colored discs are as follows: 0.1-0.2, blue; 0.2-0.3, light blue; 0.3-0.5, green; 0.5-1.0, yellow; 1-3, orange; 3-10, red; >10, fuschia.

Figure 4. Schematic diagram of a horizontal plan at approximately RL= -260m illustrating the interpreted interplay between mineralized lodes and lithologic contact between monzonite (pink) and andesite (green), in the area of the TUG-141 high-grade discovery. The NE-trending monzonite-andesite contact is shifted to the south along UR1 at the location of the mineralization intersected by drill holes TUG-141 and TUDDH-601. Lodes UR1-UR2 pair appears to merge together at depth, with the NS-oriented lodes intersected by the NE-SW UR4 lode.

Figure 5. Figure looking North and down 45° showing the next two planned drill holes (yellow) testing the high-grade zone discovery of TUG-141. Planned hole 1 from surface which has started drilling as TUDDH-608 will test the width of the zone; planned hole 2 from the underground decline is scheduled to begin drilling soon and will test for possible down plunge extent.

Table 1: Drilling intervals returning >0.5 g/t Au (intervals > 3.0 g/t Au cutoff are shown in red, and intervals > 9.0 g/t Au or longer than 1.2m are bolded).

| Hole ID | From (m) | To (m) | Interval (m) | Grade (g/t Au) |

| TUDDH-601 | 165.7 | 166.9 | 1.2 | 26.20 |

| Incl. | 165.7 | 166.3 | 0.6 | 13.38 |

| Incl. | 166.3 | 166.9 | 0.6 | 39.01 |

| 168.1 | 171.7 | 3.6 | 1.00 | |

| 190.3 | 190.6 | 0.3 | 4.21 | |

| 252.4 | 254.2 | 1.8 | 115.42 | |

| Incl. | 252.4 | 252.7 | 0.3 | 26.29 |

| Incl. | 252.7 | 253.3 | 0.6 | 159.98 |

| 284.8 | 286.3 | 1.5 | 2.37 | |

| 362.8 | 363.4 | 0.6 | 1.61 | |

| 474.1 | 474.4 | 0.6 | 7.29 | |

| Incl. | 474.1 | 474.4 | 0.3 | 5.88 |

| Incl. | 474.4 | 474.7 | 0.3 | 8.69 |

| 569.8 | 570.4 | 0.6 | 1.49 | |

| 576.1 | 596.2 | 20.1 | 23.02 | |

| Incl. | 579.4 | 579.7 | 0.3 | 142.60 |

| Incl. | 579.7 | 580.0 | 0.3 | 109.00 |

| Incl. | 580.0 | 580.3 | 0.3 | 140.90 |

| Incl. | 580.3 | 580.6 | 0.3 | 263.40 |

| Incl. | 580.6 | 580.9 | 0.3 | 74.33 |

| Incl. | 580.9 | 581.2 | 0.3 | 25.89 |

| Incl. | 581.8 | 582.4 | 0.6 | 18.52 |

| Incl. | 583.9 | 584.2 | 0.3 | 5.03 |

| Incl. | 585.7 | 586.3 | 0.6 | 9.59 |

| Incl. | 586.3 | 586.6 | 0.3 | 9.43 |

| Incl. | 586.6 | 586.9 | 0.3 | 15.49 |

| Incl. | 586.9 | 587.2 | 0.3 | 18.06 |

| Incl. | 587.2 | 587.8 | 0.6 | 5.35 |

| Incl. | 588.1 | 588.7 | 0.6 | 39.23 |

| Incl. | 588.7 | 589.0 | 0.3 | 7.13 |

| Incl. | 589.0 | 589.6 | 0.6 | 26.15 |

| Incl. | 591.4 | 592.0 | 0.6 | 10.80 |

| Incl. | 592.0 | 592.6 | 0.6 | 33.77 |

| Incl. | 592.6 | 593.2 | 0.6 | 10.94 |

| Incl. | 593.2 | 593.5 | 0.3 | 28.67 |

| Incl. | 593.5 | 593.8 | 0.3 | 32.64 |

| Incl. | 593.8 | 594.1 | 0.3 | 230.40 |

| Incl. | 594.4 | 594.7 | 0.3 | 18.26 |

| Incl. | 594.7 | 595.0 | 0.3 | 50.32 |

| 598.0 | 600.7 | 2.7 | 0.50 | |

| 602.5 | 623.2 | 20.7 | 8.09 | |

| Incl. | 603.1 | 603.7 | 0.6 | 21.52 |

| Incl. | 603.7 | 604.3 | 0.6 | 9.40 |

| Incl. | 606.1 | 606.7 | 0.6 | 20.45 |

| Incl. | 606.7 | 607.3 | 0.6 | 10.48 |

| Incl. | 607.3 | 607.9 | 0.6 | 19.67 |

| Incl. | 608.5 | 608.8 | 0.3 | 20.64 |

| Incl. | 608.8 | 609.4 | 0.6 | 10.49 |

| Incl. | 609.4 | 609.7 | 0.3 | 5.74 |

| Incl. | 610.6 | 610.9 | 0.3 | 20.31 |

| Incl. | 612.7 | 613.0 | 0.3 | 19.61 |

| Incl. | 613.0 | 613.3 | 0.3 | 120.91 |

| Incl. | 613.6 | 613.9 | 0.3 | 7.67 |

| Incl. | 613.9 | 614.2 | 0.3 | 12.69 |

| Incl. | 614.2 | 614.8 | 0.6 | 12.29 |

| Incl. | 615.1 | 615.7 | 0.6 | 11.67 |

| Incl. | 615.7 | 616.3 | 0.6 | 9.65 |

| Incl. | 616.9 | 617.5 | 0.6 | 5.48 |

| Incl. | 617.5 | 618.1 | 0.6 | 11.67 |

| Incl. | 620.8 | 621.1 | 0.3 | 5.14 |

| 625.9 | 631.0 | 5.1 | 8.37 | |

| Incl. | 626.8 | 627.1 | 0.3 | 10.01 |

| Incl. | 627.7 | 628.3 | 0.6 | 20.14 |

| Incl. | 629.5 | 629.8 | 0.3 | 18.01 |

| Incl. | 630.1 | 630.7 | 0.6 | 24.08 |

| 632.2 | 632.5 | 0.3 | 0.62 | |

| 639.1 | 640.6 | 1.5 | 0.58 | |

| 842 | 842.3 | 0.3 | 0.50 | |

| TUG-145 | 110.4 | 125.7 | 15.3 | 6.72 |

| Incl. | 110.4 | 110.7 | 0.3 | 18.77 |

| Incl. | 110.7 | 111.0 | 0.3 | 6.76 |

| Incl. | 111.9 | 112.2 | 0.3 | 6.30 |

| Incl. | 112.2 | 112.5 | 0.3 | 11.30 |

| Incl. | 115.5 | 115.8 | 0.3 | 6.91 |

| Incl. | 115.8 | 116.1 | 0.3 | 6.36 |

| Incl. | 117.3 | 117.6 | 0.3 | 40.73 |

| Incl. | 117.6 | 117.9 | 0.3 | 89.51 |

| Incl. | 117.9 | 118.2 | 0.3 | 9.80 |

| Incl. | 118.2 | 118.5 | 0.3 | 28.45 |

| Incl. | 120.3 | 120.6 | 0.3 | 7.77 |

| Incl. | 120.6 | 120.9 | 0.3 | 5.01 |

| Incl. | 120.9 | 121.2 | 0.3 | 8.62 |

| Incl. | 121.2 | 121.5 | 0.3 | 5.17 |

| Incl. | 121.5 | 121.8 | 0.3 | 13.73 |

| Incl. | 125.1 | 125.4 | 0.3 | 10.43 |

| 237.6 | 239.1 | 1.5 | 1.36 | |

| 262.8 | 263.4 | 0.6 | 3.31 | |

| Incl. | 262.8 | 263.4 | 0.3 | 5.01 |

| 278.7 | 279.6 | 0.9 | 20.38 | |

| Incl. | 278.7 | 279.0 | 0.3 | 24.16 |

| Incl. | 279.0 | 279.3 | 0.3 | 35.33 |

| 305.4 | 307.2 | 1.8 | 28.68 | |

| Incl. | 305.4 | 305.7 | 0.3 | 150.76 |

| Incl. | 305.7 | 306.0 | 0.3 | 11.51 |

| 357.9 | 368.1 | 10.2 | 4.69 | |

| Incl. | 358.8 | 359.1 | 0.3 | 6.25 |

| Incl. | 359.1 | 359.4 | 0.3 | 19.46 |

| Incl. | 359.4 | 359.7 | 0.3 | 9.21 |

| Incl. | 360.6 | 360.9 | 0.3 | 5.42 |

| Incl. | 361.8 | 362.1 | 0.3 | 5.75 |

| Incl. | 362.1 | 362.4 | 0.3 | 9.15 |

| Incl. | 362.4 | 362.7 | 0.3 | 9.83 |

| Incl. | 363.0 | 363.3 | 0.3 | 7.28 |

| Incl. | 363.9 | 364.2 | 0.3 | 14.47 |

| Incl. | 365.1 | 365.4 | 0.3 | 22.39 |

| Incl. | 366.6 | 366.9 | 0.3 | 6.03 |

| Incl. | 367.2 | 367.5 | 0.3 | 11.42 |

| 373.5 | 374.1 | 0.6 | 0.57 | |

| 375.3 | 376.8 | 1.5 | 0.83 | |

| 378.6 | 378.9 | 0.3 | 2.05 | |

| 380.4 | 381.3 | 0.9 | 1.53 | |

| 387.9 | 388.5 | 0.6 | 1.30 | |

| 405.9 | 406.2 | 0.3 | 17.8 | |

| 424.2 | 430.2 | 6.0 | 8.73 | |

| Incl. | 424.5 | 424.8 | 0.3 | 5.83 |

| Incl. | 425.7 | 426.0 | 0.3 | 8.23 |

| Incl. | 426.0 | 426.3 | 0.3 | 5.26 |

| Incl. | 426.3 | 426.6 | 0.3 | 10.37 |

| Incl. | 426.6 | 426.9 | 0.3 | 34.48 |

| Incl. | 426.9 | 427.2 | 0.3 | 76.12 |

| Incl. | 427.2 | 427.5 | 0.3 | 6.81 |

| Incl. | 429.9 | 430.2 | 0.3 | 11.61 |

| 452.7 | 453.0 | 0.3 | 1.08 | |

| 598.5 | 599.1 | 0.6 | 18.15 | |

| Incl. | 598.5 | 598.8 | 0.3 | 33.68 |

| 600.6 | 600.9 | 0.3 | 0.91 |

Table 2: Survey details of diamond drill holes referenced in this release

| Hole No | Coordinates (Fiji map grid) | RL | final depth | dip | azimuth | |

| N | E | m | (TN) | |||

| TUDDH-601 | 3920444 | 1876508 | 347.9 | 878.9 | -85 | 061 |

| TUG-141 | 3920759 | 1876459 | 139.2 | 675.0 | -55 | 162 |

| TUG-145 | 3920759 | 1876459 | 139.1 | 692.1 | -58 | 161 |

| TUDDH-608 | 3920472 | 1876281 | 286.4 | 800 planned | -65 | 089 |

| planned hole 2 | 3920582 | 1876435 | 118.0 | 500 planned | -66 | 139 |

Qualified Person

In accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), Sergio Cattalani, P.Geo, Senior Vice President Exploration, is the Qualified Person for the Company and has reviewed and is responsible for the technical and scientific content of this news release.

QAQC Procedures

Lion One adheres to rigorous QAQC procedures above and beyond basic regulatory guidelines in conducting its sampling, drilling, testing, and analyses. The Company utilizes its own fleet of diamond drill rigs, using PQ, HQ and NQ sized drill core rods. Drill core is logged and split by Lion One personnel on site. Samples are delivered to and analysed at the Company’s geochemical and metallurgical laboratory in Fiji. Duplicates of all samples with grades above 0.5 g/t Au are both re-assayed at Lion One’s lab and delivered to ALS Global Laboratories in Australia (ALS) for check assay determinations. All samples for all high-grade intercepts are sent to ALS for check assays. All samples are pulverized to 80% passing through 75 microns. Gold analysis is carried out using fire assay with an AA finish. Samples that have returned grades greater than 10.00 g/t Au are then re-analysed by gravimetric method. For samples that return greater than 0.50 g/t Au, repeat fire assay runs are carried out and repeated until a result is obtained that is within 10% of the original fire assay run. For samples with multiple fire assay runs, the average of duplicate runs is presented. Lion One’s laboratory can also assay for a range of 71 other elements through Inductively Coupled Plasma Optical Emission Spectrometry (ICP-OES), but currently focuses on a suite of 9 important pathfinder elements. All duplicate anomalous samples are sent to ALS labs in Townsville QLD and are analysed by the same methods (Au-AA26, and Au-GRA22 where applicable). ALS also analyses for 33 pathfinder elements by HF-HNO3-HClO4 acid digestion, HCl leach and ICP-AES (method ME-ICP61).

About Lion One Metals Limited

Lion One’s flagship asset is 100% owned, fully permitted high grade Tuvatu Alkaline Gold Project, located on the island of Viti Levu in Fiji. Lion One envisions a low-cost high-grade underground gold mining operation at Tuvatu coupled with exciting exploration upside inside its tenements covering the entire Navilawa Caldera, an underexplored yet highly prospective 7km diameter alkaline gold system. Lion One’s CEO Walter Berukoff leads an experienced team of explorers and mine builders and has owned or operated over 20 mines in 7 countries. As the founder and former CEO of Miramar Mines, Northern Orion, and La Mancha Resources, Walter is credited with building over $3 billion of value for shareholders.

On behalf of the Board of Directors of

Lion One Metals Limited

“Walter Berukoff”

Chairman and CEO

For further information

Contact Investor Relations

Toll Free (North America) Tel: 1-855-805-1250

Email: info@liononemetals.com

Website: www.liononemetals.com

Neither the TSX Venture Exchange nor its Regulation Service Provider accepts responsibility for the adequacy or accuracy of this release.

This press release may contain statements that may be deemed to be “forward-looking statements” within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward looking information. Generally, forward-looking information may be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “proposed”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases, or by the use of words or phrases which state that certain actions, events or results may, could, would, or might occur or be achieved. This forward-looking information reflects Lion One Metals Limited’s current beliefs and is based on information currently available to Lion One Metals Limited and on assumptions Lion One Metals Limited believes are reasonable. These assumptions include, but are not limited to, the actual results of exploration projects being equivalent to or better than estimated results in technical reports, assessment reports, and other geological reports or prior exploration results. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Lion One Metals Limited or its subsidiaries to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: the stage development of Lion One Metals Limited, general business, economic, competitive, political and social uncertainties; the actual results of current research and development or operational activities; competition; uncertainty as to patent applications and intellectual property rights; product liability and lack of insurance; delay or failure to receive board or regulatory approvals; changes in legislation, including environmental legislation, affecting mining, timing and availability of external financing on acceptable terms; not realizing on the potential benefits of technology; conclusions of economic evaluations; and lack of qualified, skilled labour or loss of key individuals. Although Lion One Metals Limited has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. Lion One Metals Limited does not undertake to update any forward-looking information, except in accordance with applicable securities laws.